Let's talk money

We're here to open up the financial conversation — helping you grow, track, manage, and save, all from one place.

Try Origin for Free(opens in new window)

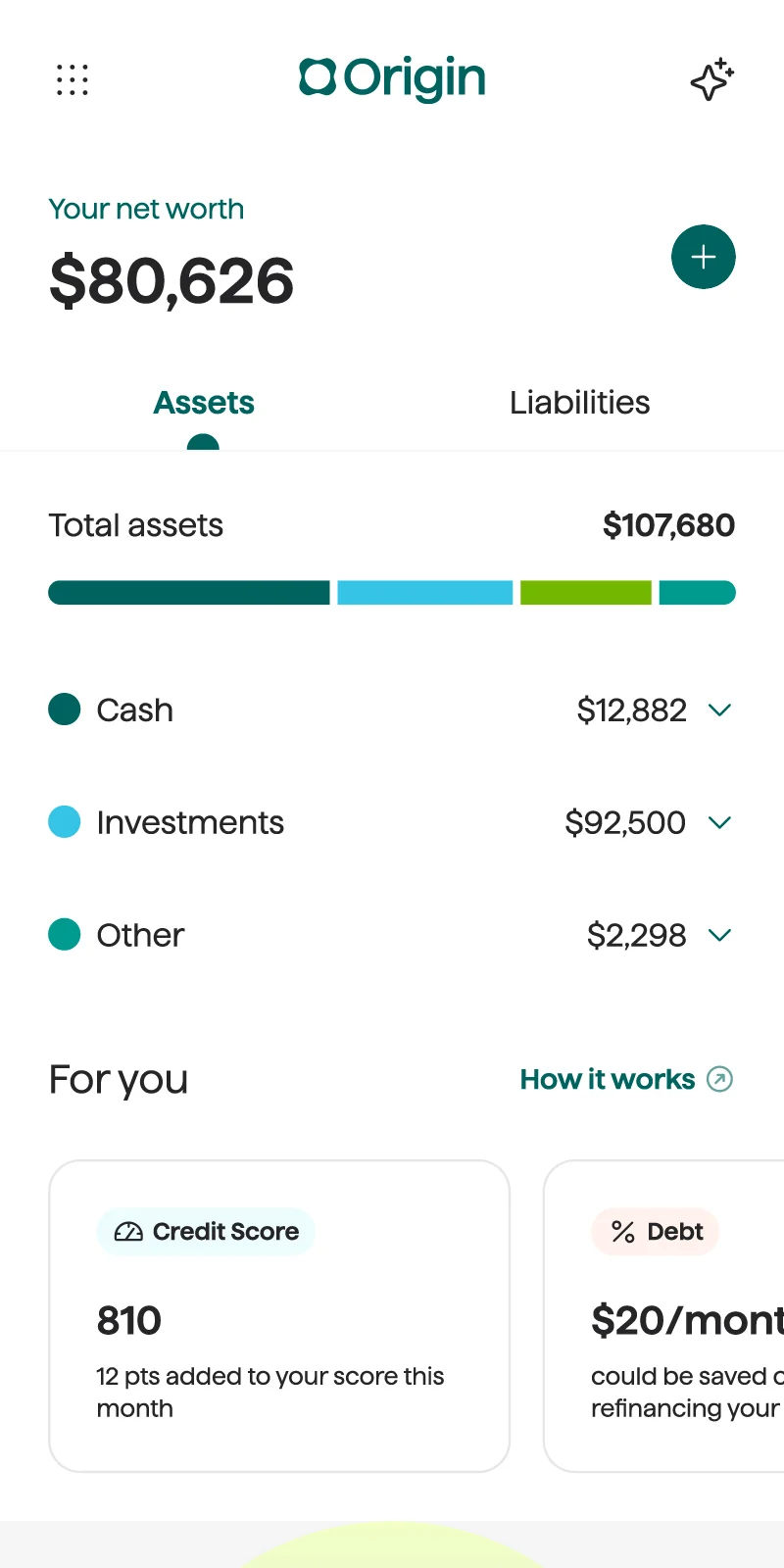

Your money, in one place

Holistic net worth tracking

Origin gives you the full picture of where money's coming in and where it's going out — so you can navigate with clarity and confidence.

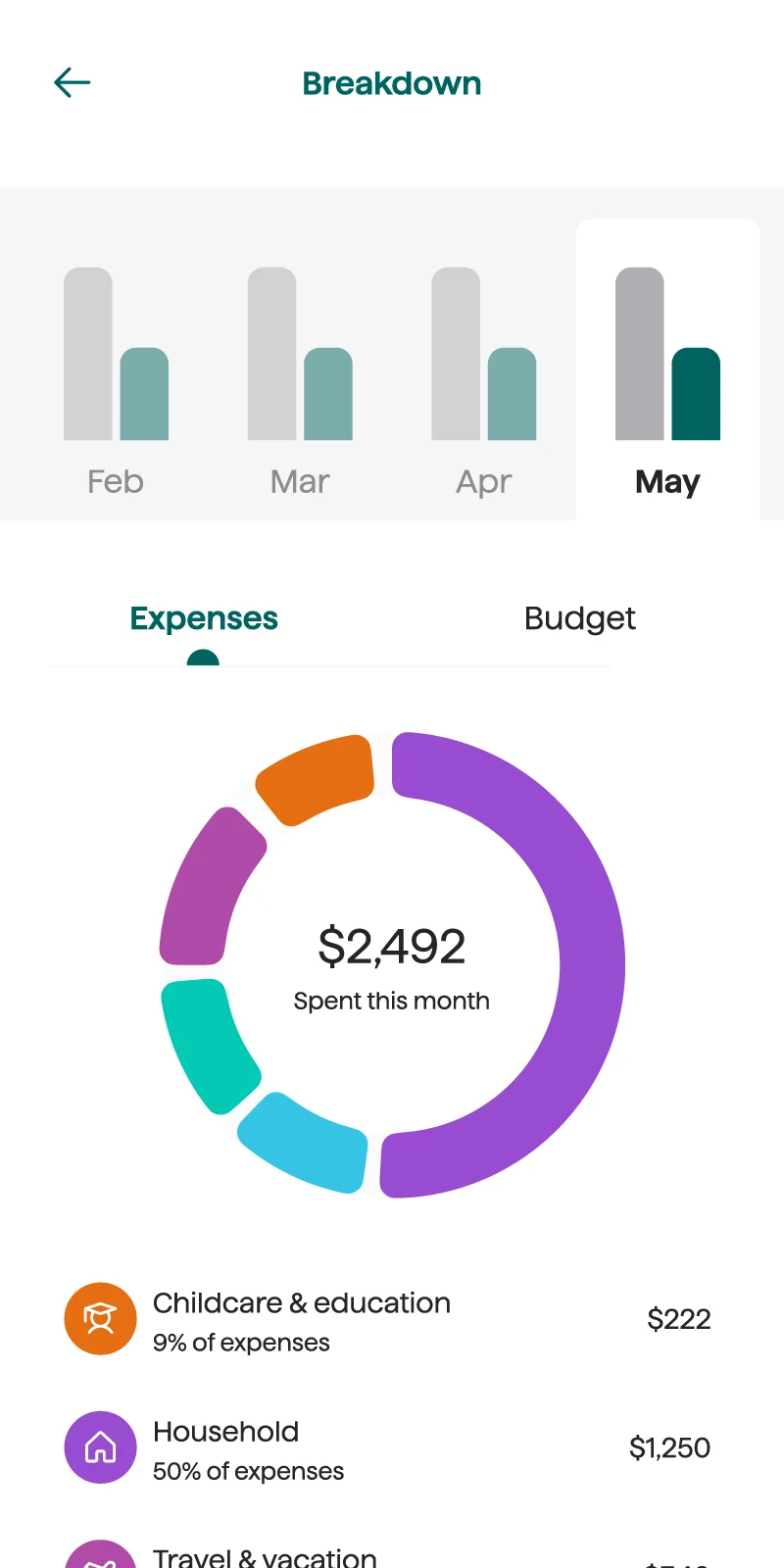

Smart recommendations to help you hit your goals

Origin automatically reviews and evaluates transactions to give actionable recommendations for budgeting and saving.

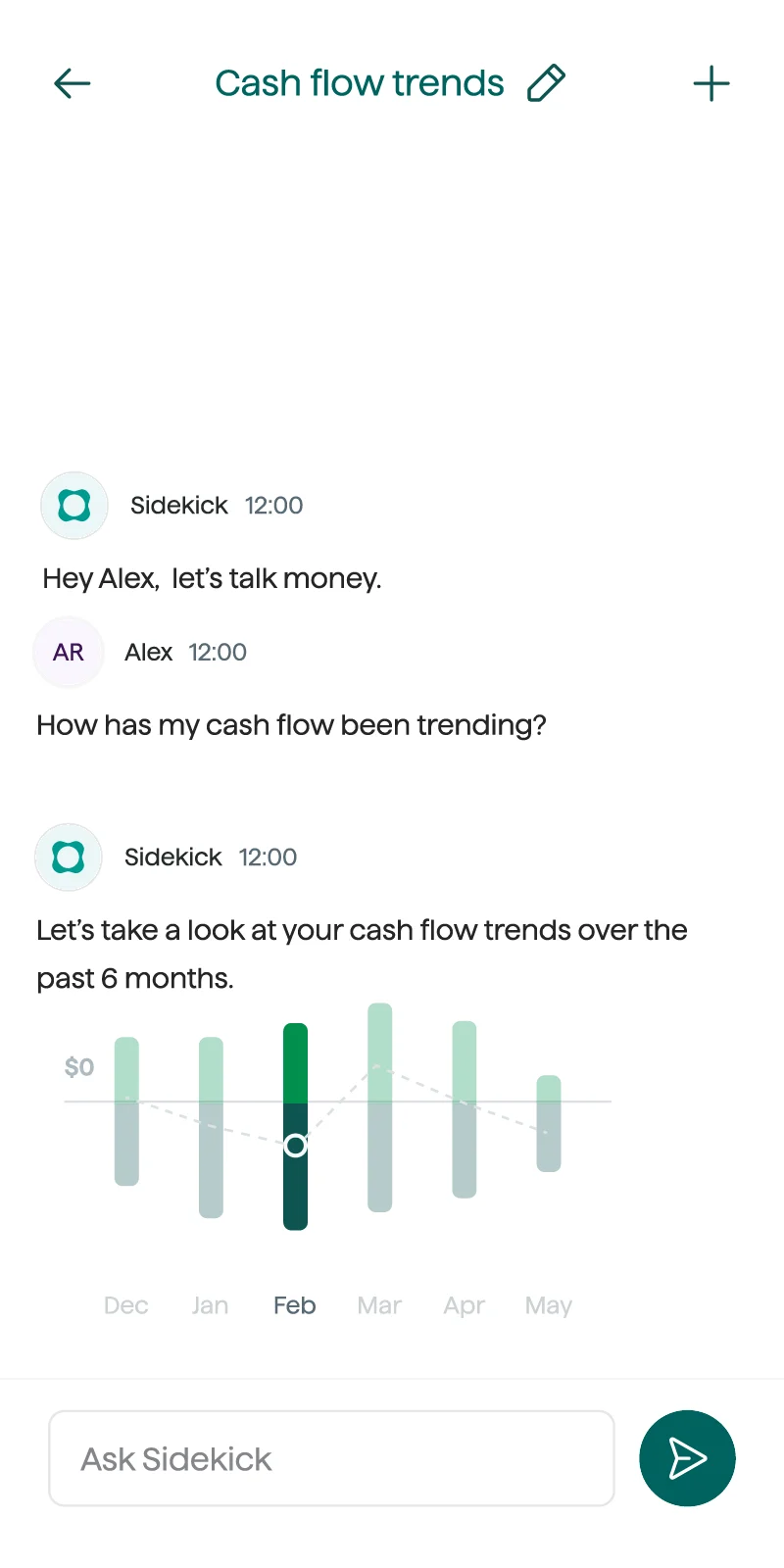

Guidance built around you

Get real-time answers to money questions with Sidekick, your AI-powered planner, or in-depth financial planning support from our Certified Financial Planners™.

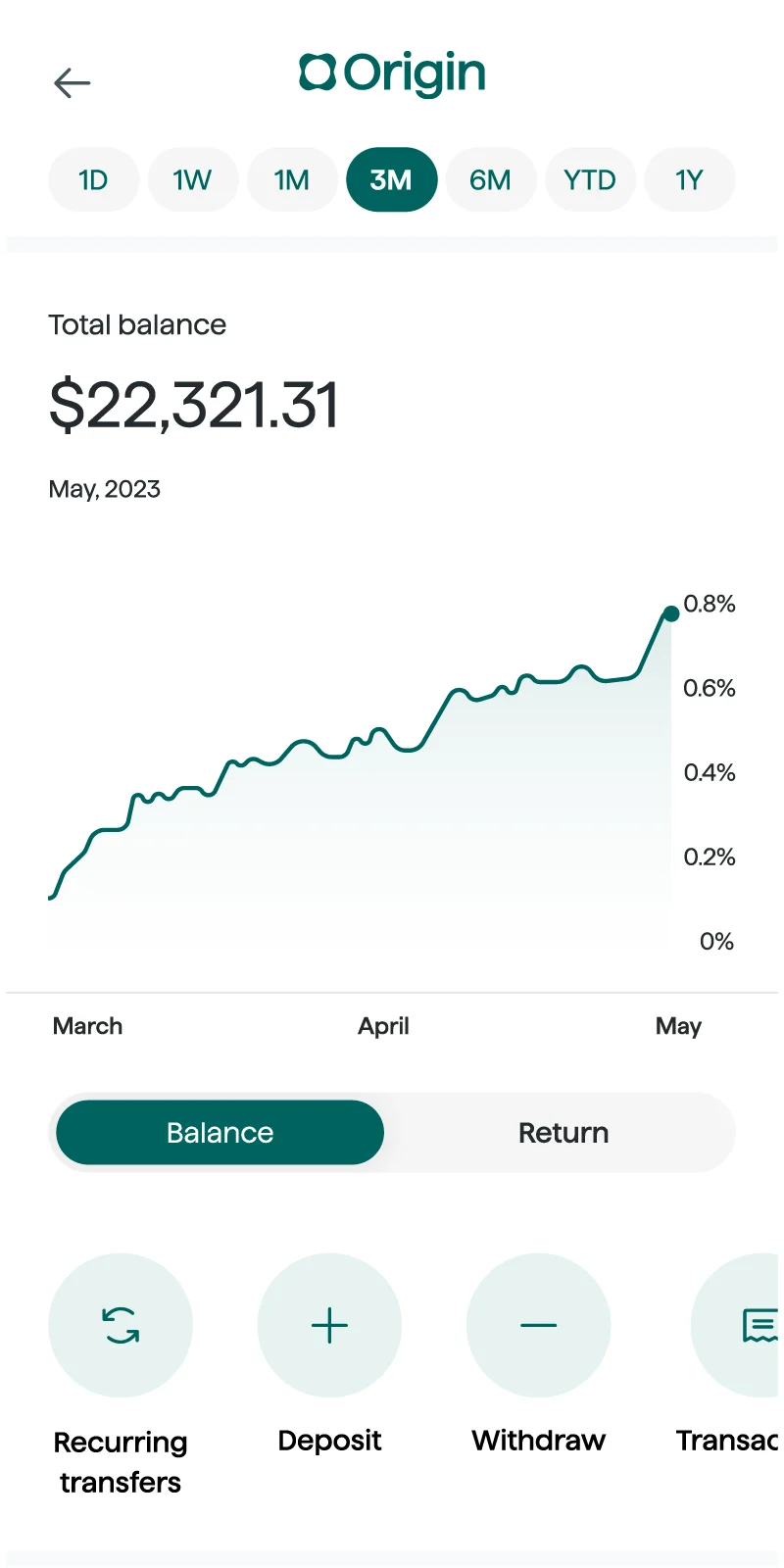

Put your money to work

Origin Invest offers automated investing with no advisory fees.

You don't have to solve money questions solo. With Origin, you'll have a trusted partner to help you through your financial journey.

Learn More

Paying off

student debt

Planning for

retirement

Budgeting

for vacation

Saving

for kids'

college

Starting a

small business

Buying a

new car

Buying a

new home

Get the full picture of your finances

24/7 financial guidance, tax assistance, budgeting and savings tools, and automated, fee-free investing — all in one place, for just $12.99/month.

Origin is the one-stop-shop for money management

Financial planning

Investing

Budgeting

Tax

Estate planning

The current market is fragmented and expensive

Financial Planning

Investing

Budgeting

Tax

Estate Planning

Vacations, budgets, credit card debt, student loans — they're all part of the conversation. Talk money to us. Try free for one month, then $12.99/month.

Get Started for Free(opens in new window)